Hyderabad’s property tax landscape in 2025 is a showcase of digital innovation, record-breaking collections, and policy driven urban transformation.

The Greater Hyderabad Municipal Corporation (GHMC) has not only exceeded its own ambitious targets but also set new standards for civic revenue, compliance, and service delivery.

Hyderabad Property Tax Record Breaking Collections and Ambitious Targets

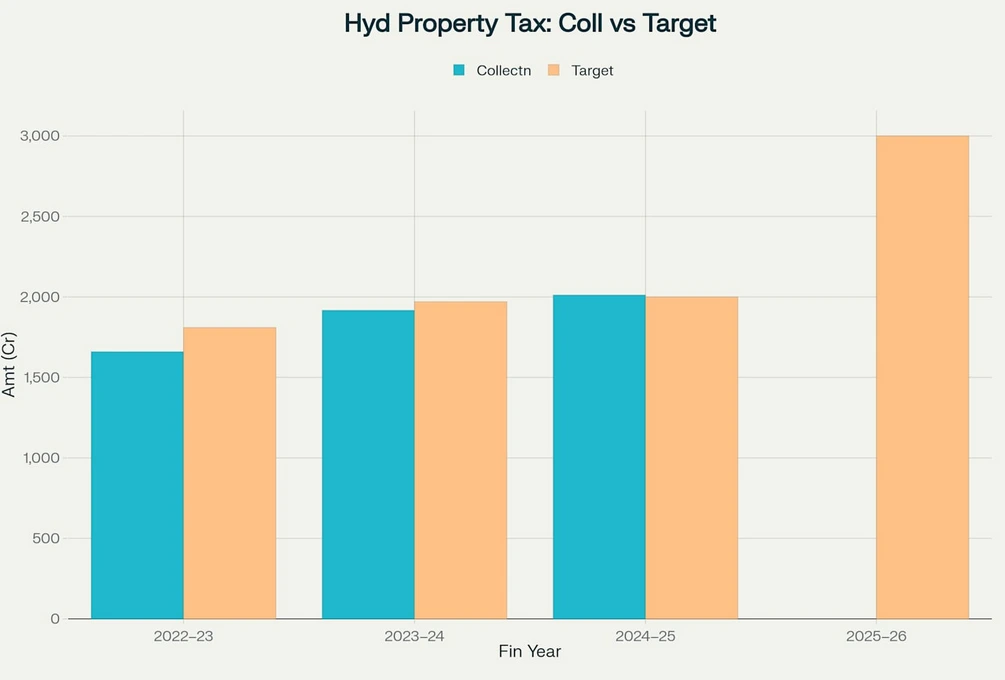

GHMC achieved its highest-ever property tax collection in FY 2024–25, crossing ₹2,012 crore and surpassing the ₹2,000 crore target for the first time.

This milestone reflects a year-on-year surge, with collections rising from ₹1,660 crore in 2022–23 and ₹1,917 crore in 2023–24.

The target for 2025–26 has now been set at an unprecedented ₹3,000 crore, signaling the city’s confidence in its digital and compliance initiatives.

Visualizing the Growth: Collection vs Target

The following table and chart illustrate Hyderabad’s property tax collection performance against targets over recent years:

| Financial Year | Collection (₹ Crore) | Target (₹ Crore) |

|---|---|---|

| 2022–23 | 1,660 | 1,810 |

| 2023–24 | 1,917 | 1,970 |

| 2024–25 | 2,012 | 2,000 |

| 2025–26 (Target) | — | 3,000 |

- Consistent Growth: Each year has seen a significant increase in both collections and targets.

- Target Surpassed: 2024–25 marked the first time collections exceeded the set target.

- Future Ambition: The 2025–26 target of ₹3,000 crore reflects GHMC’s drive for higher compliance and civic investment.

Key Drivers of Growth in Hyderabad Property Tax Collection

- One-Time Settlement (OTS) Scheme: A 90% interest waiver on tax arrears led to a windfall of ₹465 crore in less than a month, clearing backlogs and boosting immediate revenue.

- Early Bird Scheme: Over 7.5 lakh property owners availed a 5% rebate by paying their tax before April 30, 2025, contributing to a collection of ₹870 crore under this scheme alone.

- Digital Payment Platforms: Taxpayers now enjoy seamless online payments, receipt downloads, and grievance redressal, reducing the need for physical visits and increasing compliance.

Digital Transformation: Making Hyderabad Property Tax Services User-Friendly

GHMC’s digital overhaul has made all property tax services accessible online, from payment and self-assessment to grievance filing and record corrections. Residents can now:

- Pay property tax online with step-by-step guidance (Property Tax Payment Online)

- File and track grievances with Property Tax Grievance Filing and Track Status)

- Update owner name or mobile number by viewing How to Change Owner Name Property Tax, and Property Tax Mobile Number Update)

- Resolve payment issues with Property Tax Online Payment Failed Solutions

Policy Impact: Budget 2025 and Urban Development

The Union Budget 2025 has had a profound effect on Hyderabad’s property tax trends and the broader real estate market:

- Tax Relief for Middle Class: Income up to ₹12 lakh is now tax-free, increasing disposable income and enabling more families to invest in property.

- Dual Self-Occupied Property Exemption: Homeowners can now declare two properties as self-occupied and tax-free, encouraging second-home purchases and rental investments.

- Affordable Housing & Infrastructure Boost: Increased government spending on urban infrastructure and affordable housing has fueled both demand and property values, especially in emerging corridors.

- SWAMIH Fund 2: The ₹15,000 crore fund for stalled projects ensures timely completion, restoring buyer confidence and supporting market stability.

These reforms have created a favorable environment for both end-users and investors, as explored in detail in the Hyderabad Property Tax Reforms & Real Estate Investment Analysis.

Changing Taxpayer Behavior and Market Dynamics

Hyderabad’s property tax compliance is now among the highest in India, with over 16 lakh property owners paying on time. The city’s digital-first approach, combined with incentives and simplified processes, has made it easier for both local and NRI owners to manage their tax obligations remotely

- Automated Calculations: The property tax calculator and PTIN search tools allow for quick, error-free assessments and payments.

- Receipt Management: Owners can easily download receipts for compliance or loan applications, and even retrieve pre-2016 receipts.

Direct Impact on Urban Development and Real Estate

The unprecedented tax collection is funding major civic projects roads, sewage, public spaces thereby increasing live ability and, in turn, property values.

According to recent projections, Hyderabad’s real estate market is set to grow by 10–20% over the next five years, with new launches and price appreciation concentrated in tech corridors and infrastructure rich zones.

- Market Trends: Demand for both residential and commercial properties remains robust, with the city’s IT sector and infrastructure upgrades attracting investors nationwide.

- Transparency and Security: Digitized land records, regularized layouts, and online grievance mechanisms have reduced transaction risks, making Hyderabad a preferred destination for real estate investment.

Market Dynamics and Urban Impact

- High Compliance: Over 16 lakh property owners paid on time, with the highest collections from Serilingampally, Jubilee Hills, and Khairatabad.

- Urban Development: Record collections are funding roads, sewage, and public spaces, directly enhancing liveability and property values.

- Growth Outlook: Hyderabad’s real estate market is projected to grow by 10–20% over the next five years, with robust demand in both residential and commercial sectors.

Conclusion: Hyderabad’s 2025 property tax trends highlight a city at the forefront of digital governance, progressive policy, and real estate dynamism.

The synergy between robust tax compliance, citizen-friendly digital services, and forward-thinking budget reforms is not only driving record collections, but also transforming the urban landscape and investment climate.

For property owners and investors, leveraging these digital tools and policy benefits is now integral to maximizing value in Hyderabad’s evolving property market, where property tax trends in Hyderabad for 2025 are setting new benchmarks for the country.