Changing the owner name in GHMC property tax records is a crucial process for property owners in Hyderabad.

The Greater Hyderabad Municipal Corporation (GHMC) has streamlined this process online, making it accessible and efficient for all property taxpayers.

This guide details the step-by-step process to have a clear idea on how to change GHMC property tax name, covering all scenarios and ensuring you meet the latest requirements for 2025.

Name correction or ownership update ensures rightful ownership is reflected, preventing disputes and facilitating future sales or inheritance.

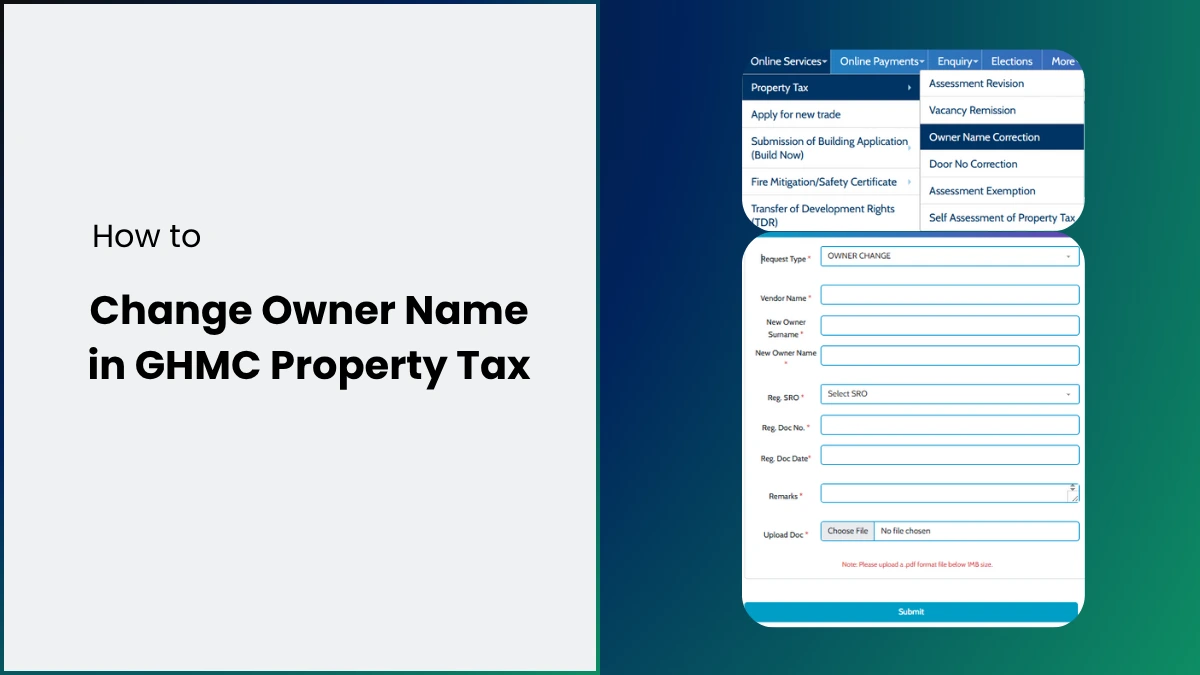

How to Change Name in GHMC Property Tax in Online

- Visit the Official GHMC Website and go to https://www.ghmc.gov.in/

- Navigate to Online Services in the top navigation bar and hover dropdown

- Select Property Tax and then Click Owner Name Correction.

- Enter the Assessment Number and registered Mobile number of your GHMC property and click on Submit.(If you don’t remember your PTIN, you can find GHMC PTIN number in Hyderabad using mobile number, owner name, or door number before starting the name change request)

- Ensure all details match your current property records to avoid processing delays.

- Select the Request Type (e.g., Owner Change).

- Enter the Vendor Name (previous owner), New Owner Surname, and New Owner Name.

- Specify the Registration SRO (Sub-Registrar Office), Registration Document Number, and Registration Date.

- Add any relevant remarks or additional information as required.

- Attach scanned copies of supporting documents (PDF copies under 1MB size) such as the registered sale deed, latest property tax receipt, and identity proof.

- Review all entered information for accuracy.

- Click Submit to complete your application.

- Note your application number for future reference and tracking.

Required Documents for GHMC Property Tax Name Change

- Registered Sale Deed or Gift Deed

- Latest Property Tax Receipt

- Identity Proof (Aadhaar, PAN, etc.)

- Encumbrance Certificate (if applicable)

- No Objection Certificate (if required)

- Other supporting documents as specified by GHMC.

Benefits of Updating Owner Name in GHMC Property Tax Records

- Ensures legal recognition of the current owner

- Prevents future disputes and eases property transactions

- Facilitates smooth GHMC property tax payment and access to municipal services once the new owner details are updated in the system.

- Required for availing exemptions or benefits for senior citizens, women, or specific property categories.

Common Scenarios for Owner Name Correction

- Sale or purchase of property

- Inheritance or succession

- Name spelling correction

- Legal name change due to marriage or other reasons.

In cases of sale, inheritance, or changes in built-up area or usage, it is often necessary to apply for GHMC property tax reassessment along with owner name correction to ensure the tax demand is updated correctly.

Tips for a Smooth GHMC Property Tax Name Change Process

- Double-check all details before submission

- Keep digital copies of all supporting documents ready

- Track your application status using the reference number provided

- Contact GHMC helpdesk for any clarifications.

Changing the owner name in GHMC property tax records in Hyderabad can be completed online by following the above simple steps, ensuring your property records are accurate and up to date as per GHMC guidelines for 2026.