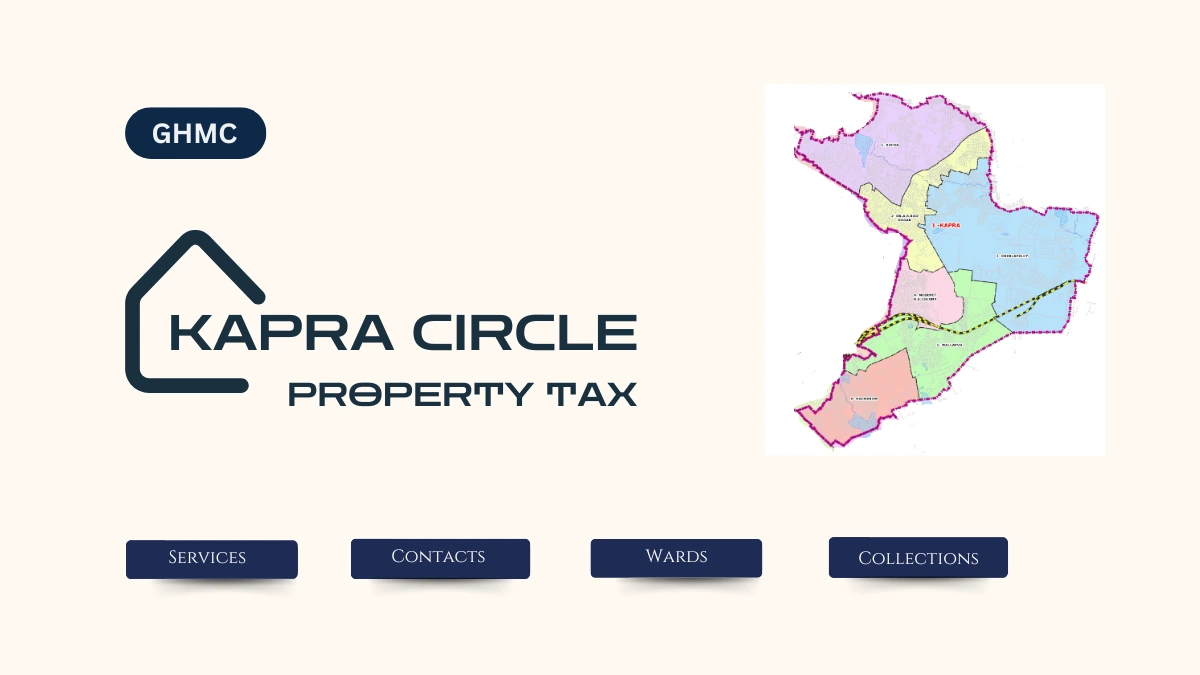

Kapra Circle Property Tax Services & Contact Details

Kapra serves as Circle Number 1 within the Greater Hyderabad Municipal Corporation (GHMC), situated in the eastern sector of Hyderabad, Telangana. This administrative division is integral to managing civic services and property tax operations for several neighborhoods. Key Details: Office Information: Kapra Circle Wards List in GHMC The Kapra Circle of GHMC includes the following wards For a broader view of GHMC administrative boundaries, you ...