Paying advance property tax GHMC has become easier than ever in 2025, especially via the official MYGHMC app, empowering Hyderabad property owners with a quick, secure, and hassle-free experience.

GHMC Advance property tax means paying your property tax before the designated due dates. When you pay property tax in advance, you benefit from early bird rebates, avoid late penalties, and may qualify for GHMC’s rewards.

This comprehensive guide covers the latest step-by-step process, scenarios, and all essential details, helping you confidently pay GHMC advance property tax and maximize available rewards.

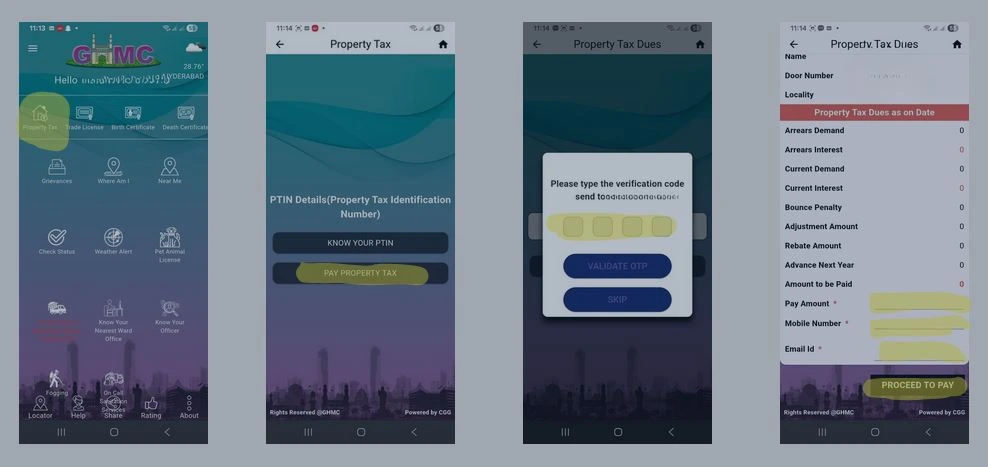

How to Pay Advance Property Tax GHMC Using the MYGHMC App

Follow these simple live steps for a seamless advance property tax payment experience:

- Download and Open the MYGHMC App: Access the MYGHMC official app from your Android or iOS store.

- Select Property Tax Section: On the homepage, tap on ‘Property Tax’ for all related services.

- Tap Pay Property Tax: Choose the option to proceed with payment.

- Enter Your GHMC PTIN Number: After performing a GHMC property tax search by PTIN or door number if you don’t have it handy, PTIN is mandatory to fetch your property details correctly.

- Click ‘Know Property Tax’: This will display your property’s current and previous years’ tax details.

- Enter OTP Sent to Registered Mobile Number: An OTP is delivered to your registered mobile; input it to verify your access.

- Click Validate OTP: This step authorizes you to view and pay your property tax.

- Check Your Property Tax Details: Review tax details, outstanding dues, and any advance payment benefits.

- Enter the Payable Amount for Advance Payment: You can choose to pay either the exact tax, advance for future periods, or any preferred amount.

- Enter Your Email Address for receipt and notification purposes.

- Click Proceed to Pay.

- Select your preferred payment mode: UPI, debit/credit card, net banking, or wallet and Complete transaction securely.

- Save Your Payment Receipt: Download or screenshot the payment receipt for future reference.

Benefits of Paying Advance Property Tax GHMC via App

- Early Bird Rebates: Qualified payers enjoy up to 5% discount for payments before the rebate deadline (April 30).

- Automatic Entry into Lucky Draw: Advance payers get a chance to win prizes when announced by GHMC.

- Real-Time Updates and Instant Receipts: No more waiting, receive GHMC tax receipt instantly.

Can I Pay for Future Years or Advanced Installments?

- Yes, app allows custom entry in PAY Amount for current or future advance installments.

Are Offline Payment Options Still Available?

- Yes, you can pay at GHMC offices or MeeSeva centers, but the app remains fastest and most convenient.

Key Deadlines and Schemes

- Early Bird Rebate Deadline: Pay by April 30 for rebate.

- Regular Payment Deadlines: July 31 and October 15 for half-year installments.

- Penalty: 2% per month on overdue payments.

Whether you’re a first-time user, regular payer, senior citizen, business owner, or non-resident, the MYGHMC app supports secure and advance property tax payment for residential and commercial properties – Check GHMC property tax online payment failed solutions if transactions glitch.

Comparison Table for GHMC Property Tax Advance Payment Modes

| Method | Advance Payment | Real-time Receipt | Rebate | Lucky Draw Entry (When Announced) | Convenience |

|---|---|---|---|---|---|

| MYGHMC App | Yes | Yes | Yes | Yes | Highest (use GHMC circles and wards list for accurate PTIN lookup) |

| GHMC property tax online Payment (portal) | Yes | Yes | Yes | Yes | High |

| MeeSeva/Offline | Yes | Yes/No (physical) | Yes | Yes | Moderate |

Advance property tax GHMC payment is now easier than ever complete your transaction via the MYGHMC app in minutes to benefit from rebates and rewards when announced in 2025.