Property owners in Hyderabad often face challenges with GHMC property tax grievance and some don’t know about whom to complain regarding property tax from incorrect assessments to payment discrepancies and self assessment approvals.

The Greater Hyderabad Municipal Corporation has streamlined the process through online for addressing these concerns, ensuring transparency and efficiency for all stakeholders.

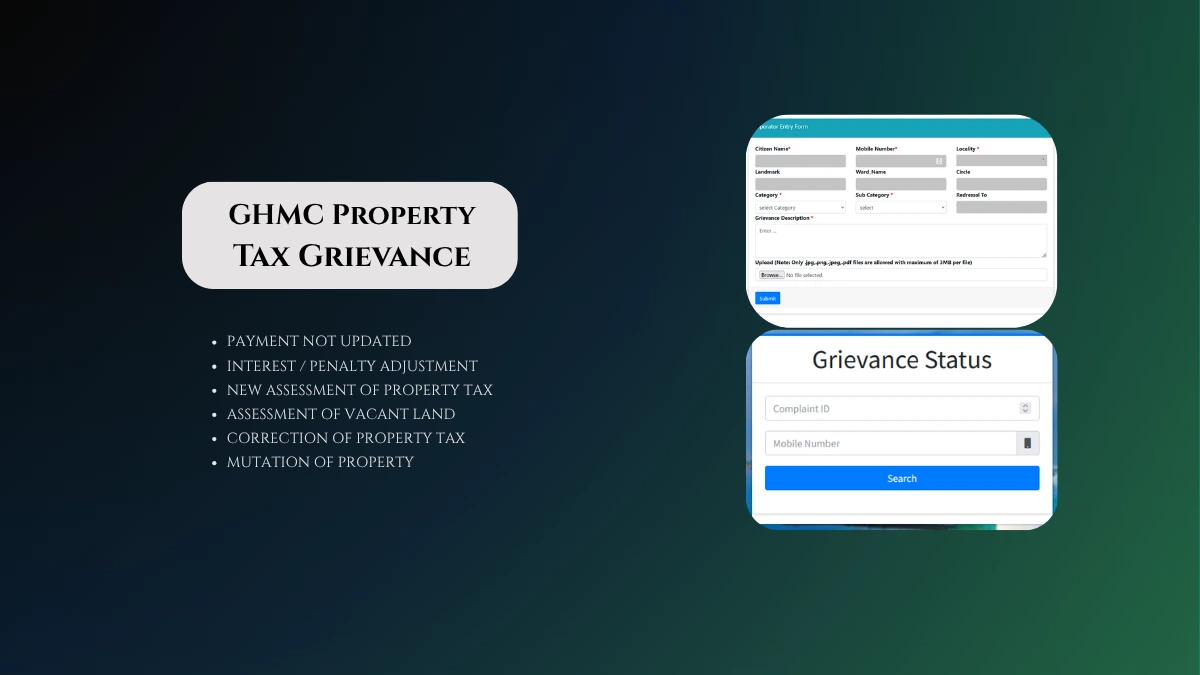

A GHMC property tax grievance refers to any issue related to property tax that requires official intervention. Common grievances and technical errors also include in the new online portal. Just let you know the online steps:

How to File GHMC Property Tax Grievance Online

- Navigate to office website ghmc.gov.in and hover to Online Services

- Tap on Grievance and Citizen

- Provide your mobile number and Click Send OTP > Proivde OTP and Click Submit OTP

- Enter your Name (as per property tax information)

- Select Locality from dropdown and enter Landmark (for easy identification)

- Select Revenue (Property Tax) as the category.

- Select the appropriate Sub-category for your property tax issues (payment not updated, interest / penalty, change of name, assessment, vacant land, correction of dorr number, address, exemption, GIS mobile verification)

- Clearly explain your issue in description.

- Upload supporting documents with relevant files (receipts, notices etc..) in accepted formats. If you need a copy of your receipt, simply download it from the GHMC Property tax receipt section.

- Click submit to generate a unique GHMC Complaint ID for tracking purposes.

How to Check GHMC Property Tax Grievance Status

- Follow the 1st 3 steps in above process.

- Enter your complaint ID or Registered mobile number (during the grievance).

- Click Submit and get the current status / resolutions provided by GHMC officials.

Offline GHMC Property Tax Grievance Redressal

GHMC conducts Property Tax Parishkaram (PTP) sessions every Saturday in all circles and zonal offices.

These sessions address pending mutations, legal cases, revision petitions, new assessments, and other property tax related matters.

Grievances are either resolved on the spot or followed up for early resolution. Before visiting the office, ensure your PTIN is accurate by using the GHMC PTIN search Hyderabad tool so that officials can quickly trace your property tax records.

Common GHMC Property Tax Grievances and Solutions

- Incorrect Assessment: File a grievance online or attend PTP sessions for reassessment.

- Payment Not Updated: If your payment is not reflected, submit your proof and lodge a complaint through the GHMC portal. If you faced transaction issues, follow GHMC property tax online payment failed solutions to understand how to handle debited-but-not-updated payments before raising a formal grievance.

- Self-Assessment Not Approved: Review the GHMC property tax self assessment procedure to confirm that all required details and documents are correctly submitted, and then follow up at the circle office or through the online grievance system.

- Technical Errors: Report technical issues online or via the GHMC WhatsApp helpline.

GHMC Property Tax helpline number

GHMC offers a dedicated helpline number at 040-23225397. This provides an additional channel for residents to get clarity.

GHMC Property Tax Grievance : Frequently Asked Questions

How long does it take to resolve a GHMC tax grievance?

Most grievances are resolved either on the spot during PTP sessions or within a few days via the online system.

What documents are required to file a GHMC grievance?

Property tax receipts, assessment notices, and identity proof are typically required, and you can always download your GHMC Property tax receipt if needed.

What is the process to file a grievance for incorrect property assessment by GHMC officials?

If you found the incorrect property assessment of yours, then file the grievance as per the appropriate selection for the type of grievances allowed as shown in the above steps.

Can I file a grievance for a mutation request?

Yes, mutation requests can be submitted online or during PTP sessions.

Tips for Smooth GHMC Property Tax Grievance Resolution

- Regularly check the status of your grievance online.

- Attend PTP sessions for faster resolution of complex issues.

- Verify your property details using GHMC property tax search by PTIN, name or door number and ensure your GHMC PTIN is accurate before any official visit or grievance submission.

Conclusion: Addressing grievance is now more accessible with multiple channels for filing and tracking complaints for property owners in Hyderabad. You can expect timely and transparent resolution of their property tax issues, ensuring a smoother experience with GHMC property tax grievance processes and improved municipal service delivery.