Property owners in Hyderabad must initiate a GHMC property tax reassessment to ensure their tax records and liabilities reflect the latest modifications during different scenarios as below.

- If you have constructed additional floors, rooms, or extensions.

- The usage of your property has changed (e.g., residential to commercial).

- There have been major renovations or structural changes affecting the plinth area.

- You have demolished and rebuilt any part of the property.

Before or along with reassessment, new or significantly altered properties should be first covered under GHMC property tax self assessment online to create or update the base assessment correctly.

GHMC Property Tax Reassessment after Property Modification

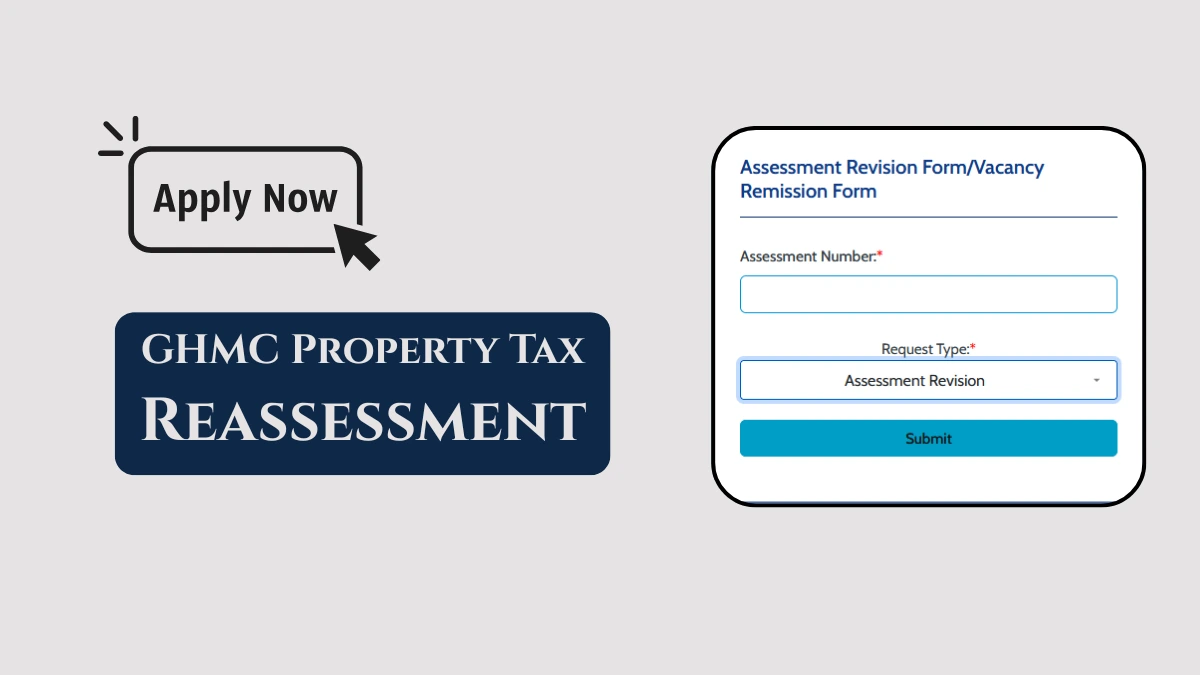

- Go to the official assessment revision form page at sa.ghmc.gov.in/MeesevaARVR.aspx

- Enter your existing Property Tax Identification Number (PTIN) under Assessment number; if you do not remember it, use GHMC PTIN search Hyderabad to quickly find your correct PTIN before applying for reassessment.

- Choose the Request Type as Assessment Revision for property modifications (such as construction, extension, or change of usage).

- Click the Submit button to proceed.

- Enter all updated property details, such as:

- New plinth area (if additional construction has been made)

- Modification details (e.g., added floors, change in usage)

- Date of completion of modification

- Supporting documents (upload scanned copies of building permission, completion certificate, latest photographs, etc.)

- Upload Typical documents required:

- Copy of sanctioned building plan reflecting modifications

- Latest property tax receipt

- Ownership proof (sale deed, etc.)

- Photographs of the modified property.

- GHMC officials will review your application and may conduct a site inspection to verify the changes.

- Once verified and approved, the revised property tax will be calculated.

- You will receive a reassessment order with the updated tax amount. Once the new liability is confirmed, you can pay GHMC property tax online after reassessment using the official payment portal for faster clearance of dues and to avoid penalties.

- The order and updated details can be downloaded from the portal or will be sent via SMS/email notification.

The GHMC property tax reassessment process is now fully online, reducing the need for physical visits and speeding up approvals.

What if I disagree with the reassessed tax amount?

You can file a revision petition against the assessment order, providing supporting documents and your objections for review by GHMC officials, or file GHMC property tax grievance online to raise issues like incorrect reassessment or calculation errors through the official grievance system.

How long does it take for GHMC property tax reassessment after making a modification request?

Typically, the GHMC aims to process reassessment applications within 15 days of submission, subject to verification and site inspection.

Can I apply GHMC reassessment offline?

While online applications are encouraged for faster service, you may still approach GHMC Citizen Service Centers for assistance if needed.

Applying for GHMC property tax reassessment after property modification is crucial to ensure your tax records are up-to-date and compliant with municipal regulations.

Use the official GHMC portal for a seamless and transparent process, and always download GHMC property tax receipt online after payment so you have updated proof for future reassessment or grievance needs.