GHMC property tax assessment is the process of determining the annual tax liability for a property within the Greater Hyderabad Municipal Corporation limits.

The assessment is based on the property’s usage (residential, commercial, etc.), plinth area, location, and age.

Who Needs GHMC Property Tax Assessment?

- New Property Owners: If you have constructed a new building in GHMC area or made significant changes to an existing structure, a fresh assessment is mandatory.

- Existing Property Owners must get GHMC property tax reassessment done whenever there are changes in property usage, built-up area, or ownership details.

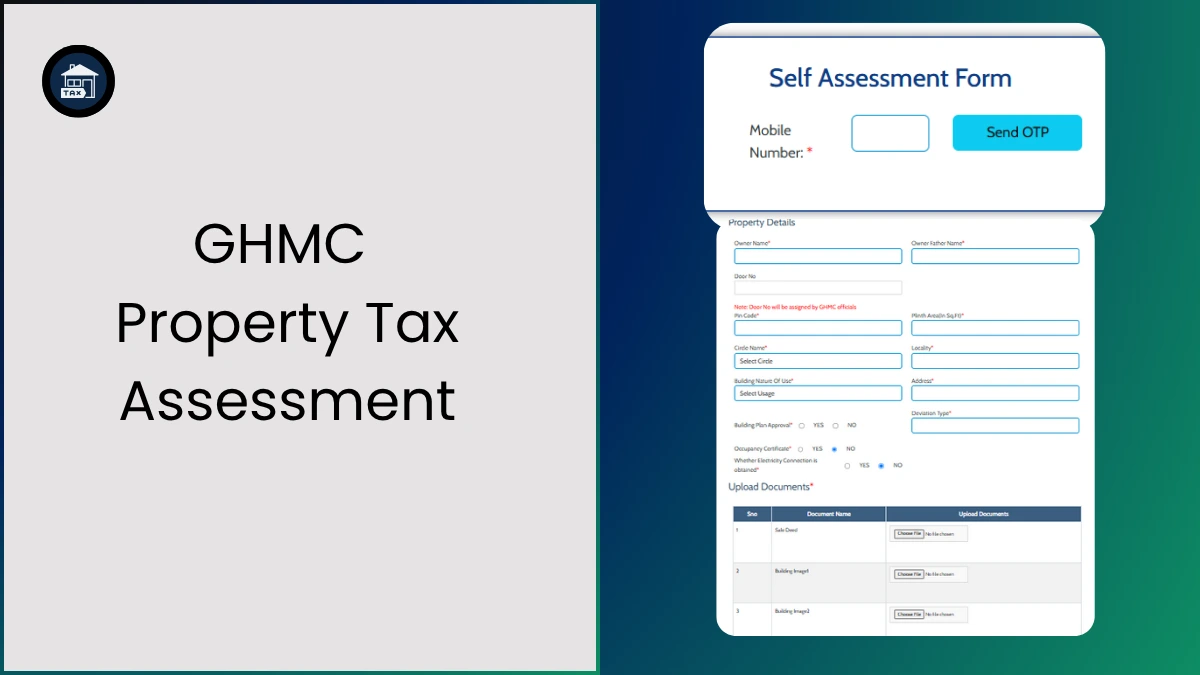

How to Apply GHMC Property Tax Self Assessment Online

- Go to the official GHMC self assessment form by using https://sa.ghmc.gov.in/SelfAssessment.aspx

- Enter your mobile number and request an OTP.

- Enter the received OTP to verify your identity and continue.

- Choose the SRO

- Input your registration document number, and specify the document date.

- Fill in all property details accurately, including plinth area, usage type, location, and ownership particulars.

- Upload necessary supporting documents like your sale deed, approved building plan, and clear property photographs.

- Agree to the declarations

- Submit your application.

- The portal will automatically compute your property tax according to GHMC regulations and display the payable amount.

- After your self assessment is approved, you can pay GHMC property tax online using net banking, credit/debit card, UPI, or other options.

- GHMC authorities will review your submission and may schedule a site inspection if needed.

- After verification, you’ll receive an SMS alert to download your property tax assessment certificate directly from the portal.

Required Documents to Apply GHMC Property Tax Self Assessment

The below are the required for new and existing properites, just be ready with all and upload as per your requirement asked at the moment in online or offline

- Proof of Ownership: Sale deed/title deed

- Aadhaar Card: For identity verification

- Property Address Details

- Previous Tax Receipts

- Property Measurement Details

- PAN Card

- Occupancy Certificate (for new properties)

- Recent Utility Bills.

For Existing Properties

- Routine Assessment: Corporation periodically reviews property tax assessments.

- Revision: Assessment can be revised if there are changes in property usage, area, or structure.

- Documentation: Keep previous GHMC property tax receipts and ownership documents handy for any verification.

- If you do not remember your PTIN or want to verify dues before reassessment, use GHMC property tax search by PTIN, name, mobile number, or door number.

Key Points to Remember when raising GHMC property tax assessment

- Timely Assessment: New properties must be assessed within 15 days of completion.

- Accuracy: Ensure all details and documents are accurate to avoid delays or penalties.

- Penalties: Late payments or non-compliance can attract penalties and interest.

The GHMC property tax self assessment procedure is a structured process that ensures accurate determination of tax liabilities for properties within GHMC limits.

Whether you own a new or existing property, understanding the assessment steps, required documents, and calculation methods or with property tax calculator, which will help you comply with regulations and avoid penalties.

The process is streamlined with options for online self assessment, making it convenient for property owners to fulfill their civic responsibilities. Once you complete payment, always download GHMC property tax receipt online and keep it as proof for future assessments, loans, or legal verification.