The GHMC PTIN (Property Tax Identification Number) is a unique code assigned to every property under the Greater Hyderabad Municipal Corporation (GHMC).

This number is essential for property owners to manage records, pay GHMC property tax online, and track their property tax obligations efficiently.

Each property whether residential, commercial, or institutional receives its own PTIN, making it the primary reference for all property tax related transactions in Hyderabad.

There are 2 types of GHMC PTI numbers before or after digitization, Let’s check the differnece

- 10 digit PTIN : Assigned to properties assessed after digitization.

- 14 digit PTIN : Used for older properties under the legacy system. Owners of such properties can convert their PTIN to the new format by applying at the GHMC office.

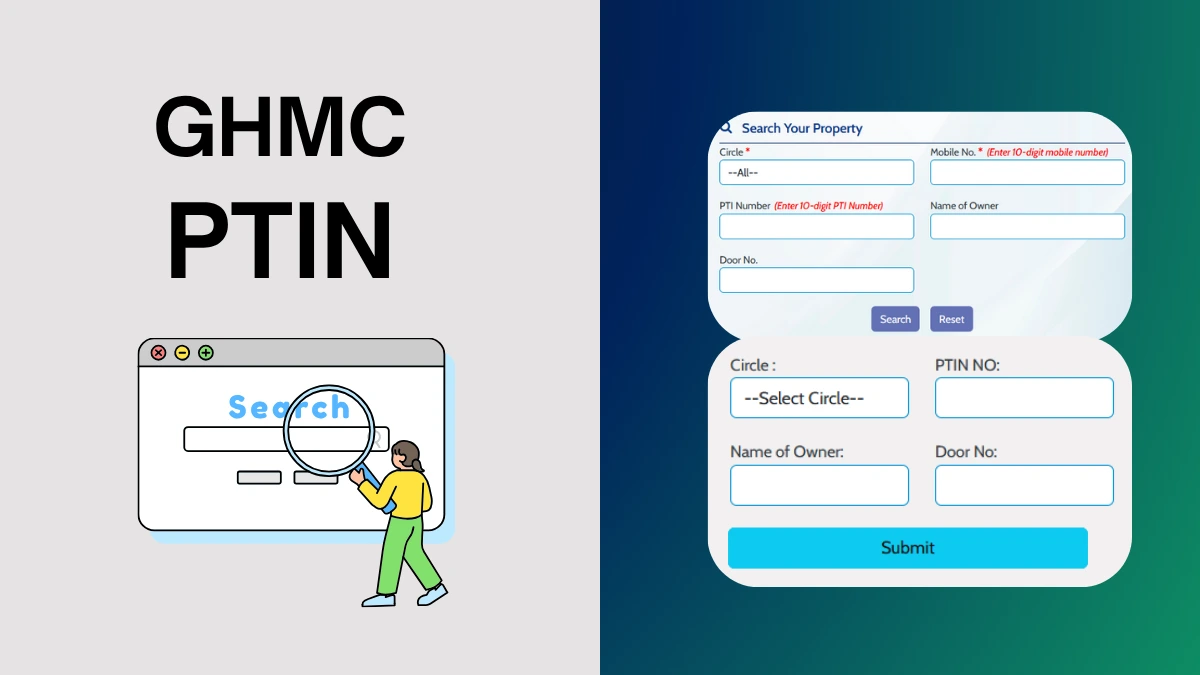

How to Find PTIN number for Property Tax Hyderabad using onlinepayments.ghmc.gov.in

This is the process to search GHMC property tax details Using Mobile Number and Owner Name or Door Number to know PTIN and other information:

- Visit the webpage https://onlinepayments.ghmc.gov.in/

- Tap on Know your PTI Number

- Select the GHMC Circle for which your property belongs from dropdown list

- Enter your GHMC registered mobile number (this is required).

- Provide Name of the Owner or Door Number

- Click Search

- Get OTP and validate .

- Complete the CAPTCHA code and click Search.

- The system will display all GHMC property tax records linked to the provided owner’s name or door number, along with full tax details.

These steps allow you to conveniently retrieve GHMC property tax details and PTIN search using your mobile number, owner name, or door number.

How to Find GHMC PTIN using ghmc.gov.in

To easily find your property tax information for properties under the Greater Hyderabad Municipal Corporation (GHMC), follow these instructions:

- Go to the official GHMC website: ghmc.gov.in.

- Navigate to the menu and select: Our Services > Property Tax > Property Tax > GHMC.

- Click on Know Your Property Tax Details. This will take you to the search page at ghmc.gov.in/Search.aspx

- Select your GHMC administrative circle.

- Choose your preferred search method as any from the below:

- Door Number: Input your property’s door number and select the relevant circle.

- Owner Name: Enter the name of the registered property owner.

- Click the Submit button and complete the CAPTCHA verification if prompted.

- Your property tax details, including payment history, pending dues, and other relevant information will be displayed on the screen.

These steps provide a straightforward way to access your property tax records through the GHMC portal.

Alternate Identifiers to find PTIN number GHMC

If you don’t know your property tax identification number, use your door number, owner name, or registered mobile number to search for your property on the GHMC portal, then the below is the only as a solution:

Property Documents: Check previous property tax receipts or your sale deed; PTIN is often printed on these documents.

Offline Methods: Visit your local Greater Hyderabad Municipal Corporation office with proof of ownership (sale deed, old tax receipts, or property address) to retrieve or verify your PTIN.

How to Generate GHMC PTIN for New Properties

For newly constructed or reassessed properties:

- For newly constructed or reassessed properties, first complete your GHMC property tax reassessment or assessment application with all required documents (sale deed, occupancy certificate, building plan approval, identity proof) via the GHMC website or at the municipal office.

- After verification, and upon approval, a new 10-digit PTIN assigned.

What to do if i lose or cannot find my GHMC PTIN

- Use the GHMC portal’s search feature with your door number or owner’s name by following the above said process.

- Visit the local GHMC office with property documents for assistance.

- Check the GHMC tax receipts or sale deeds for the PTIN.

Legal and Compliance Implications of Missing or Incorrect GHMC PTIN

- Delayed Transactions: Property sales, mutations, or loans may delayed or denied.

- Penalties: Non payment or incorrect PTIN can attract penalties up to 2% per month on outstanding dues.

- Ownership Issues: Inability to prove ownership or update records can lead to disputes and loss of property rights.

If your PTIN or tax records are incorrect, you can file a GHMC property tax grievance online to correct assessment, payment, or PTIN-related issues.

Managing your property tax obligations in Hyderabad is seamless when you understand the role of the GHMC PTIN.

The unique identifier GHMC PTIN for properties in Hyderabad not only facilitates online tax payments and compliance but also ensures smooth property transactions and legal security.